Zydus Share News: Zydus Lifesciences hits all-time high stock price on stellar Q3 results and strategic buyback decision.

also read RVNL Share News: Why Rvnl Share Is Falling? Get To Know It’s Future

Historic Surge in Share Price

Zydus Lifesciences, a prominent pharmaceutical company, marked a significant milestone on February 9, 2024, as its share price surged to an all-time high. From its humble beginnings at Rs 34.80 in 2009, the stock soared to an unprecedented level, reaching Rs 820.95, signaling remarkable growth over the years. As trading closed for the day, the share settled at Rs 805.05, reflecting investor confidence in the company’s performance and potential.

Stellar Financial Results

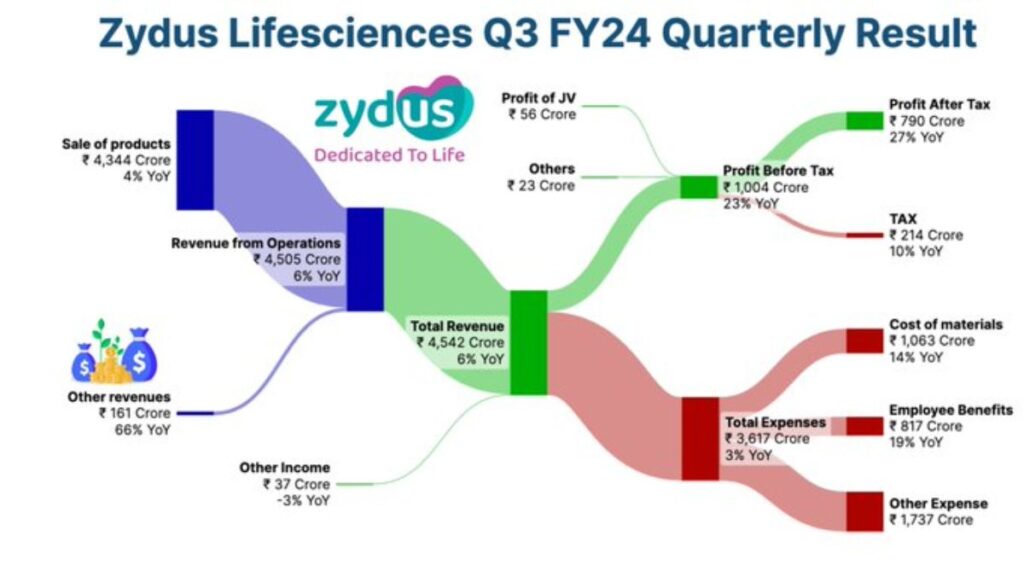

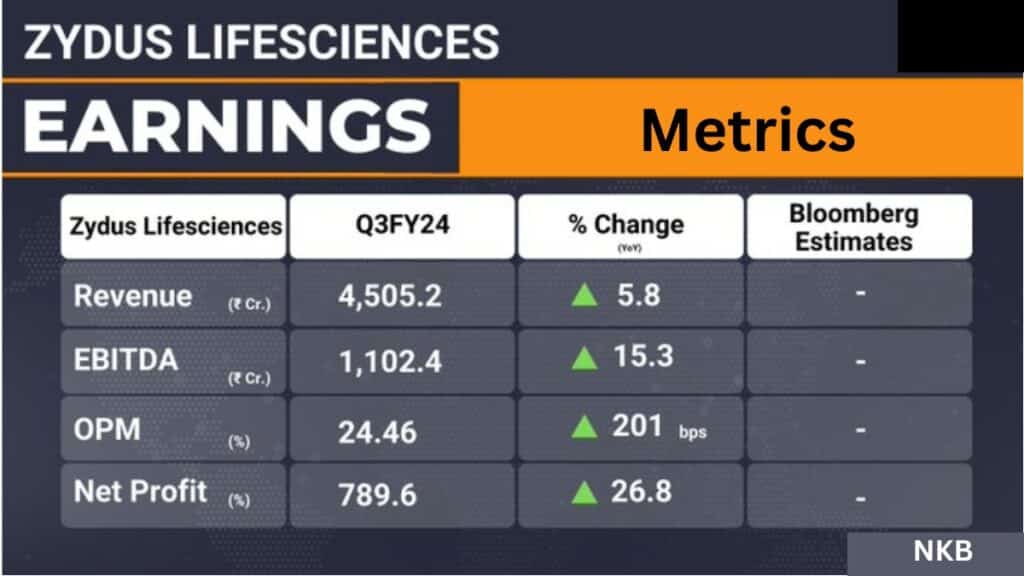

The surge in share price coincides with Zydus Lifesciences’ impressive financial performance for the December quarter of the financial year 2023-2024. The company reported a robust 26 percent growth in consolidated net profit, reaching Rs 789.6 crore compared to Rs 622.9 crore in the year-ago period. Additionally, revenue from operations saw a notable increase of 5.8 percent, totaling Rs 4505.2 crore, as disclosed in the exchange filing.

Strategic Decision: Share Buyback

In a strategic move to enhance shareholder value, Zydus Lifesciences’ board approved a buyback of 57.9 lakh shares worth Rs 600 crore at Rs 1,005 per share via the tender offer route. This decision underscores the company’s commitment to maximizing shareholder returns and confidence in its future prospects.

Robust Operational Metrics

The company’s financial performance was further bolstered by robust operational metrics. Zydus Lifesciences reported earnings before interest, taxes, depreciation, and amortization (EBITDA) at Rs 1,102 crore, up from Rs 956 crore in the year-ago period. Moreover, the EBITDA margin witnessed a healthy increase, reaching 24.4 percent compared to 22.5 percent a year ago.

Optimistic Outlook : Zydus Share News

Dr. Sharvil Patel, Managing Director of Zydus Lifesciences Limited, expressed optimism about the company’s growth prospects. He cited a differentiated portfolio in the US market and the continued performance of key brands as key drivers of growth. Dr. Patel also highlighted the robust execution engine supporting their growth initiatives, indicating a promising future ahead.

Shareholding Pattern

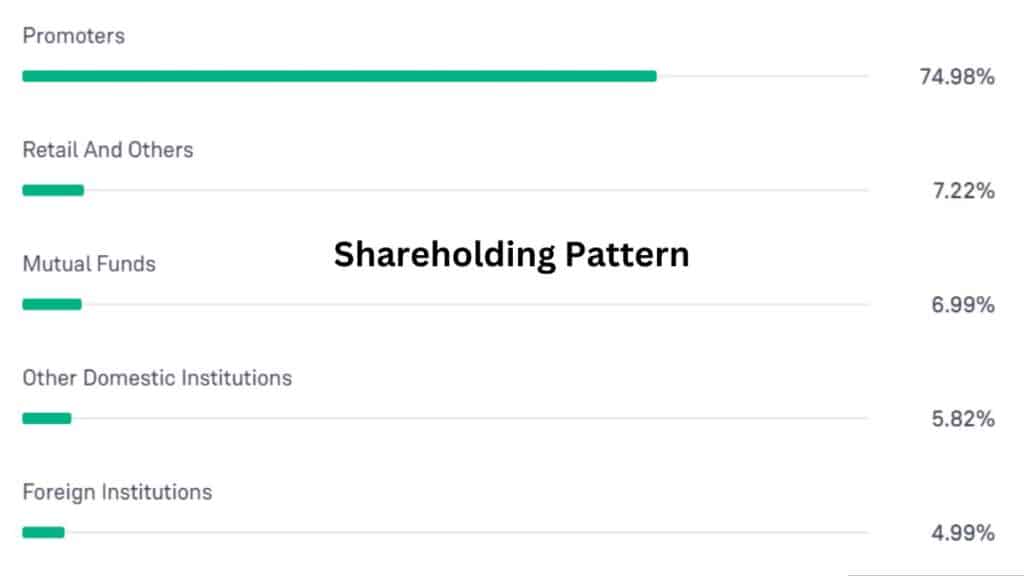

In Zydus Lifesciences, the shareholding pattern reveals a dominance of promoters, who hold a substantial 74.98% stake in the company, indicating their strong control and commitment to its growth trajectory. Retail investors and others collectively hold 7.22%, reflecting a moderate level of individual ownership. Mutual funds and other domestic institutions have notable stakes of 6.99% and 5.82%, respectively, showcasing their confidence in the company’s potential. Foreign institutions hold a smaller but still significant 4.99% stake.

Conclusion: Zydus Share News

Zydus Lifesciences’ remarkable journey to an all-time high share price underscores its strong performance, strategic decisions, and promising outlook. As the company continues to innovate and expand its presence in the pharmaceutical industry, investors remain optimistic about its growth trajectory and potential returns.

This article provides insights into Zydus Lifesciences’ historic surge in share price, its stellar financial results, strategic decisions, and future outlook, aligning with the central keyword ‘Zydus Share News.’

also read Zydus Lifesciences Ltd (ZYDUSLIFE) Share Price