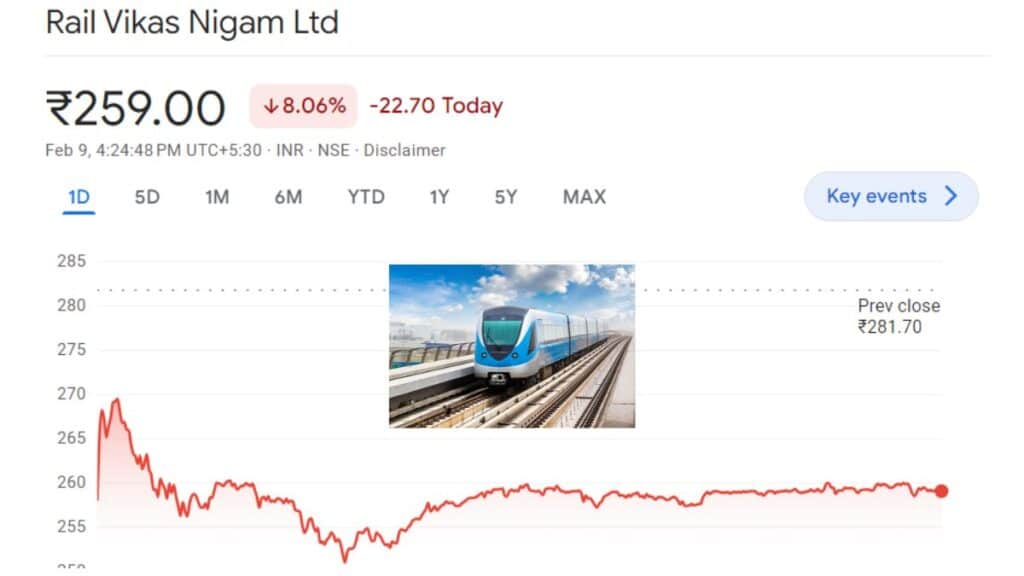

RVNL Share Price: Following the announcement of a 6.2 percent year-on-year decline in net profit for the December quarter, Rail Vikas Nigam Limited (RVNL) witnessed an 8.06 percent decrease in its stock price, closing on February 9th.

also read RVNL Share News: Why Rvnl Share Is Falling? Get To Know It’s Future

Introduction: RVNL Share Price

The closing stock price on the previous day stood at 281.70, while today’s closing price settled at 259.00, indicating a decrease of 22.70 points. This decline translates to a percentage decrease of 8.06%. he drop in stock price is attributed to the Q3 results announced by the company.

Brief history and background of RVNL

Rail Vikas Nigam Limited (RVNL) stands as a pivotal Indian central public sector enterprise, operating as the construction arm of the Ministry of Railways, dedicated to the implementation and enhancement of transportation infrastructure. Established in 2003, RVNL emerged in response to the escalating infrastructural demands of the nation, aiming to expedite project delivery and establish a railway equipment construction company.

RVNL in the railway infrastructure sector

Notably, it holds the prestigious status of being a ‘Navratna’ Central Public Sector Enterprise (CPSE) in India, operating under the administrative oversight of the Indian Ministry of Railways. RVNL’s operational scope encompasses the entire project lifecycle, from conceptualization to execution and commissioning, facilitated through the creation of project-specific Special Purpose Vehicles (SPVs). Integral to its mission is the mobilization of additional resources beyond the budgetary allocations, achieved through a judicious blend of equity and debt financing facilitated by these SPVs.

Q3 Result of RVNL: RVNL Share Price

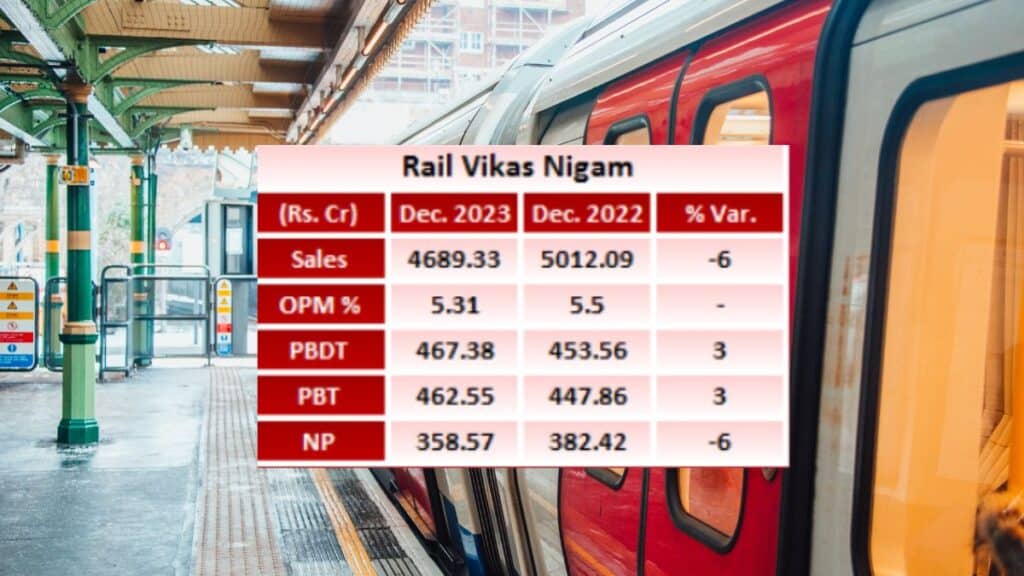

During the quarter, Rail Vikas Nigam witnessed a 6.2 percent year-on-year decline in profit, amounting to Rs 359 crore, primarily attributed to subdued top-line and operating performance. Despite this, revenue saw a 6.4 percent increase, reaching Rs 4,689.3 crore. However, the company’s EBITDA for the reporting period experienced a 9.6 percent decrease, totaling Rs 249.1 crore.

Factors contributing to the decline in net profit

The decline in net profit can be attributed to several key factors. Firstly, revenue from operations in the reporting quarter decreased by 6%. Secondly, there was a notable decline of 9.6% in Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA). Additionally, the margin experienced an 80 basis points decline sequentially, dropping from 6.1% in September.

Market Condition & Industry trend

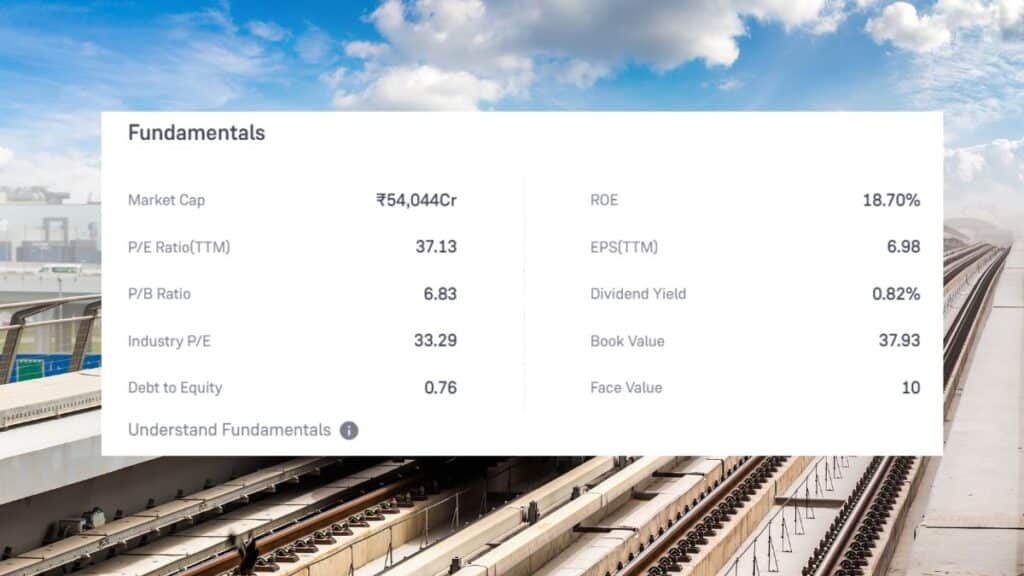

The recent downturn marks a significant departure from RVNL’s performance over the past year. During this period, the company’s stock experienced a remarkable surge, soaring by more than 270%. RVNL had distinguished itself as a top performer within the railway sector, standing out amidst its peers. However, the current setback reflects a shift in market conditions and industry trends, highlighting the challenges faced by the company in sustaining its earlier momentum.

Market expectations for RVNL’s performance

In July, the government divested a 5.4% stake in RVNL at Rs 119 per share. Despite this initial valuation, the stock has since demonstrated an impressive performance, more than doubling in value. This upward trajectory underscores a robust growth trend for RVNL. As indicated by the December shareholding pattern, the government continues to maintain a significant 72.84% stake in RVNL, valued at over Rs 40,000 crore. Such a substantial stakeholding suggests continued confidence in RVNL’s potential performance and future prospects within the market.

Conclusion: RVNL Share Price

The strong government ownership in RVNL, coupled with its consistent performance, instills confidence in the company’s long-term prospects. Despite short-term fluctuations, RVNL’s strategic positioning within the infrastructure sector and its proven track record position it favorably for future growth. Investors may find solace in the government’s continued support and the company’s resilience, indicating potential opportunities for value appreciation over the long haul.

Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of News Ki Baat

also read RVNL stock price falls 5% as Q3 profit falls

1 thought on “Why RVNL Share Price Has Tumbled More Than 8% In A Single Day?”

Comments are closed.