Why is Coal India Share Price Falling? Discover why the share price of Coal India is experiencing a downturn. Explore the factors influencing this decline, the impacts on the company, investor sentiment, and the long-term outlook.

Table of Contents

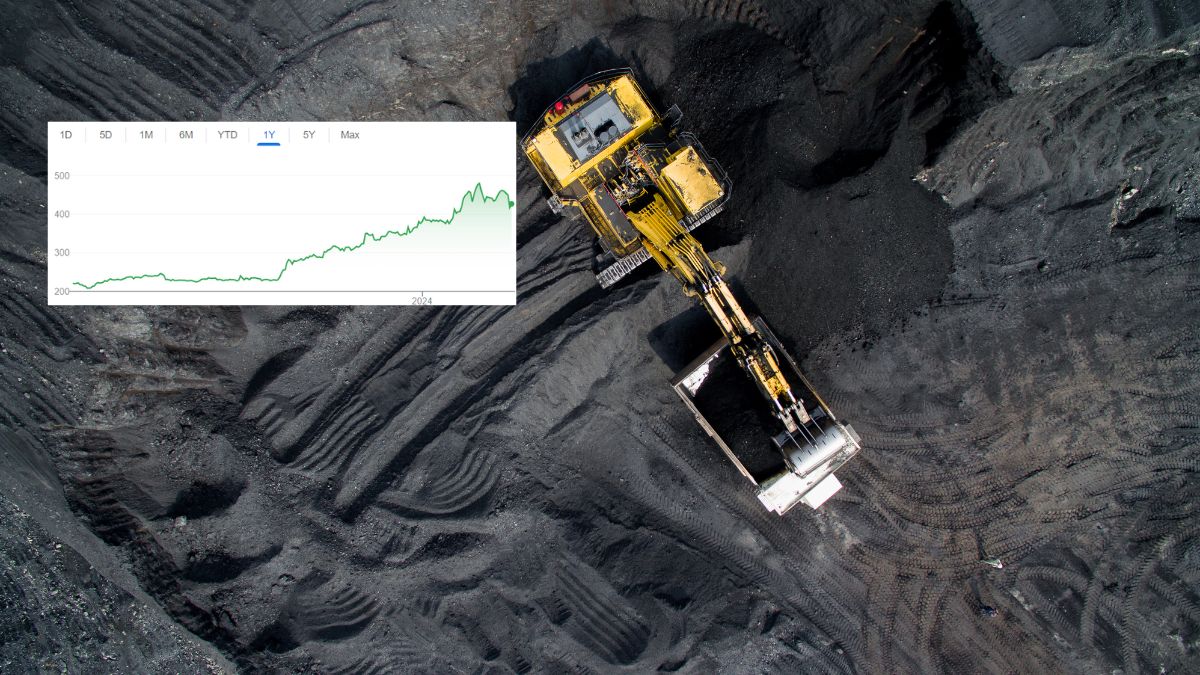

Introduction: Why Is Coal India Share Price Falling

Coal India, one of the largest coal mining companies globally, has recently seen a decline in its share price. This article delves into the reasons behind this downturn and its implications. Coal India Share Price movements always requires technical and financial analysis.

Factors Contributing to Share Price Fall

Coal India Price Predictions is very difficult. There are many factors contributing to it:

Global Coal Market Trends

The global coal market is undergoing significant shifts, with a decreasing demand for coal due to environmental concerns and the rise of renewable energy sources.

India’s Energy Transition

India, a major market for coal, is undergoing an energy transition, with a focus on reducing carbon emissions and increasing reliance on cleaner alternatives like solar and wind power.

Government Policies and Regulations

Government policies aimed at reducing coal usage and promoting cleaner energy sources have impacted Coal India’s operations and profitability.

Competition from Renewable Energy Sources

The growing competitiveness of renewable energy sources poses a significant challenge to coal companies like Coal India.

Impacts on Coal India

The declining share price has profound implications for Coal India, affecting its financial performance and posing operational challenges. Technical analysis such as Coal India Share Price RSI can help you in this regard.

Investor Sentiment

Analysis of Investor Sentiment towards Coal Industry

Investors’ sentiment towards the coal industry is influenced by various factors, including environmental concerns, regulatory changes, and market dynamics.

Market Reactions to News and Events

News and events related to coal, such as policy announcements and market trends, can trigger significant fluctuations in Coal India’s share price.

Long-term Outlook

Future Prospects for Coal India

Despite the current challenges, Coal India retains long-term potential, especially with strategic adaptation to changing market dynamics.

Potential Strategies for Recovery

Exploring diversification into cleaner energy sources and investing in technology and innovation could help Coal India navigate through this challenging period.

Conclusion: Why Is Coal India Share Price Falling?

In conclusion, the decline in Coal India’s share price stems from a combination of global trends, regulatory changes, and market dynamics. However, the company remains resilient, with opportunities for recovery and growth in the long run.

also read: Coal India stock looks attractive to Jefferies with 27% upside potential

2 thoughts on “Why Is Coal India Share Price Falling? Overview”

Comments are closed.