Table of Contents

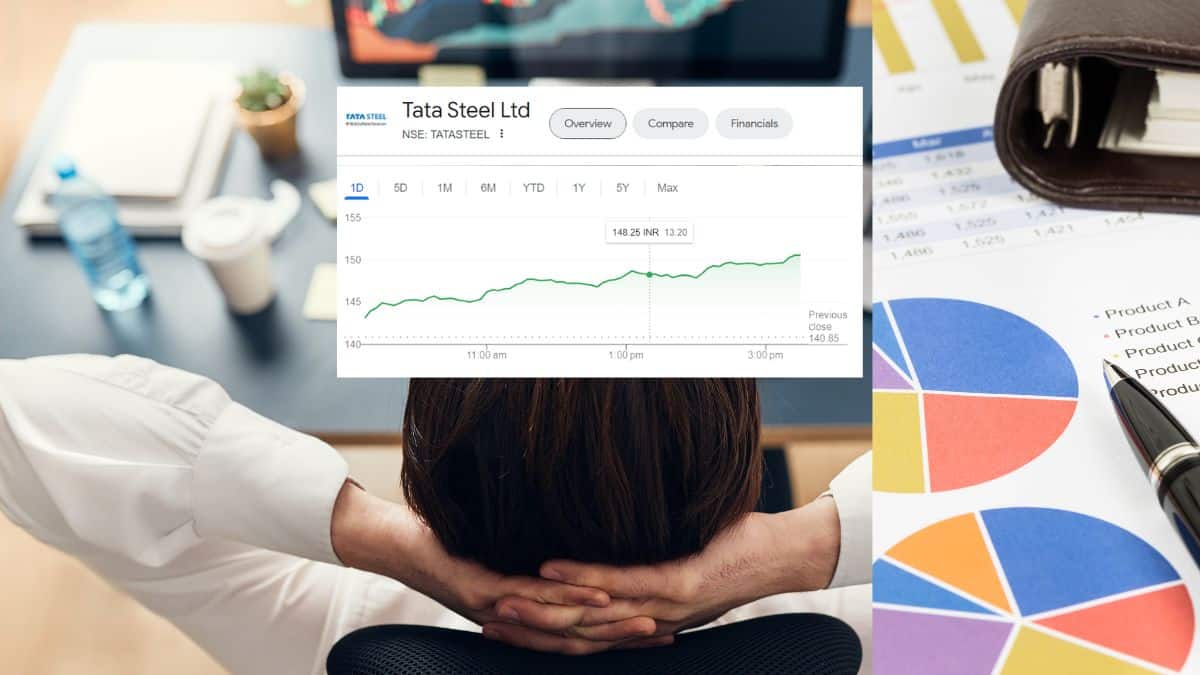

Tata Steel Share: In this article, we delve into the fascinating world of technical analysis to track and interpret the movements of Tata Steel shares. Exploring various indicators and methodologies, we aim to equip investors with the tools and insights necessary to navigate the dynamic fluctuations of the stock market effectively.

also read: RVNL Share News: Latest News On Market Performance and Developments

Introduction: tata steel share price today

In the dynamic world of stock markets, understanding the movements of individual stocks requires a blend of analytical tools and market insights. Tata Steel, a prominent player in the steel industry, is no exception. In this article, we delve into the fascinating realm of technical analysis to monitor the movement of Tata Steel shares, unraveling the indicators and methodologies essential for informed decision-making in the realm of stock trading.

Technical Analysis: Tata Steel Share Rate

Technical analysis is a powerful tool utilized by traders and investors to analyze past price movements and forecast future trends based on market data. When applied to Tata Steel shares, technical analysis involves scrutinizing various indicators such as moving averages, relative strength index (RSI), and trend lines to gain insights into the stock’s price movements.

SWOT Analysis: Tata Steel Share

Conducting a SWOT analysis of Tata Steel reveals its strengths, weaknesses, opportunities, and threats, providing valuable insights for strategic decision-making and risk management in a dynamic and competitive business environment. Here is dynamic tool that can help you.

RSI Price Change & More

In analyzing Tata Steel shares, a comprehensive approach incorporating key technical indicators and fundamental factors is essential for informed decision-making. Utilizing tools such as Relative Strength Index (RSI), Simple Moving Average (SMA), Exponential Moving Average (EMA), oscillators, and pivot points provides valuable insights into the stock’s price movements and trend direction.

Quality, Valuation and Technical Score:

Assessing the quality, valuation, and technical score of a share provides a holistic view for investors seeking to make informed decisions. Quality metrics delve into the fundamental strength of the company, evaluating factors such as profitability, debt levels, and management efficiency.

Check Before You Buy:

Before diving into purchasing Tata Steel scrip, it’s crucial for investors to conduct a thorough assessment to ensure informed decision-making. Evaluating key factors such as the company’s financial health, market position, and industry outlook is paramount.

Financial Analysis:

Tata Steel vs Reliance vs HDFC : Market Cap, Net Income Chart

Company’s Financial Metrics Table:

Tata Steel’s financial metrics table provides a comprehensive snapshot of the company’s performance and financial health. It will help you in making descision.

Tata Steel: Brief History

Formerly known as Tata Iron and Steel Company Limited (TISCO), Tata Steel stands as a global titan in the steel industry, boasting an annual crude steel capacity of 35 million tonnes. With operations spanning the globe, Tata Steel is renowned for its unparalleled geographical diversification, positioning itself as one of the world’s most widely spread steel producers.

In the fiscal year ending on March 31, 2023, the group, excluding its operations in South East Asia, achieved a consolidated turnover of US$31 billion, reflecting its robust financial performance on the global stage. Domestically, Tata Steel holds the mantle as India’s largest steel company by domestic production, boasting an annual capacity of 21.6 million tonnes, second only to Steel Authority of India Ltd. (SAIL).

Notably, Tata Steel, alongside SAIL and Jindal Steel and Power, enjoys a distinct advantage as one of the three Indian steel companies with captive iron-ore mines, providing a strategic edge through enhanced price control and operational efficiency.

Conclusion: Tata Steel Share Price

In conclusion, monitoring Tata Steel shares through technical analysis provides investors with valuable insights into the stock’s movements and potential opportunities. By utilizing tools such as moving averages, relative strength index (RSI), and oscillators, investors can identify trends, gauge momentum, and make more informed trading decisions. Technical analysis offers a systematic approach to analyzing Tata Steel’s price movements, helping investors navigate the complexities of the market with greater confidence and precision.

Disclaimer:

News Ki Baat provides stock market news for informational purposes only and that should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.

Related Topic: Tata Steel Share

| Tata Steel stock hits Rs 150 mark for first time; is the upside capped? |