RVNL Share Price: Today, on February 12, 2024, Rail Vikas Nigam’s stock price experienced a decline of -7.68%, closing at 259.2 per share. Currently, the stock is trading at 239.3 per share. It’s advisable for investors to closely observe RVNL’s stock price in the forthcoming days and weeks to gauge its response to this development.

also read RVNL Share News: Why Rvnl Share Is Falling? Get To Know It’s Future

Introduction: RVNL Share Price

Rail Vikas Nigam Limited (RVNL) holds a significant position in India’s railway sector, contributing to the nation’s extensive railway infrastructure. Established in 2003, RVNL operates as a Special Purpose Vehicle (SPV) under the Ministry of Railways.

Its primary objective is to expedite the modernization and expansion of railway infrastructure across the country. RVNL plays a pivotal role in executing various projects, including the construction of new railway lines, gauge conversion, doubling of existing lines, electrification, and the development of multi-modal logistics parks.

With a focus on enhancing connectivity, efficiency, and safety within the railway network, RVNL has become a key player in driving India’s transportation infrastructure forward.

Factors influencing RVNL share price

A. Financial performance

RVNL’s share price is significantly influenced by its financial performance, which is closely scrutinized by investors.

I) Revenue Growth:

Firstly, revenue growth serves as a key indicator of the company’s ability to generate income from its operations. A decrease in revenue (Q3 result) signals a lesser demand for RVNL’s services and projects, which harmed its share price. However, year-on-year charts show continuous revenue growth. Thus, any decline in share price is likely temporary.

II) Profitability :

Secondly, profitability, including metrics like operating profit and net profit , reflects RVNL’s efficiency in managing costs and generating profits. Lesser profitability (Q3) often lead to decreased investor confidence and a potential retard in share price. However, last five year chart shows continuous increase in profitability. So, there is temporary decline in shareholder’s confidence.

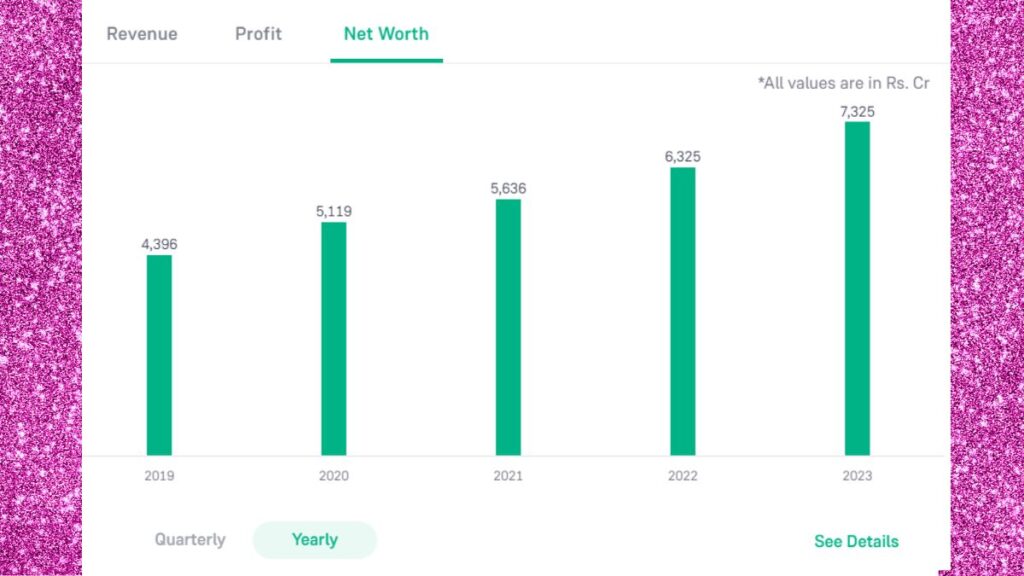

III) Net Worth:

Lastly, Net Worth play a crucial role in determining RVNL’s financial health and risk profile. Continuous growth indicates a stronger balance sheet and reduce the company’s financial risk, which can positively influence investor sentiment and contribute to share price appreciation.

Analysis of recent share price movements:

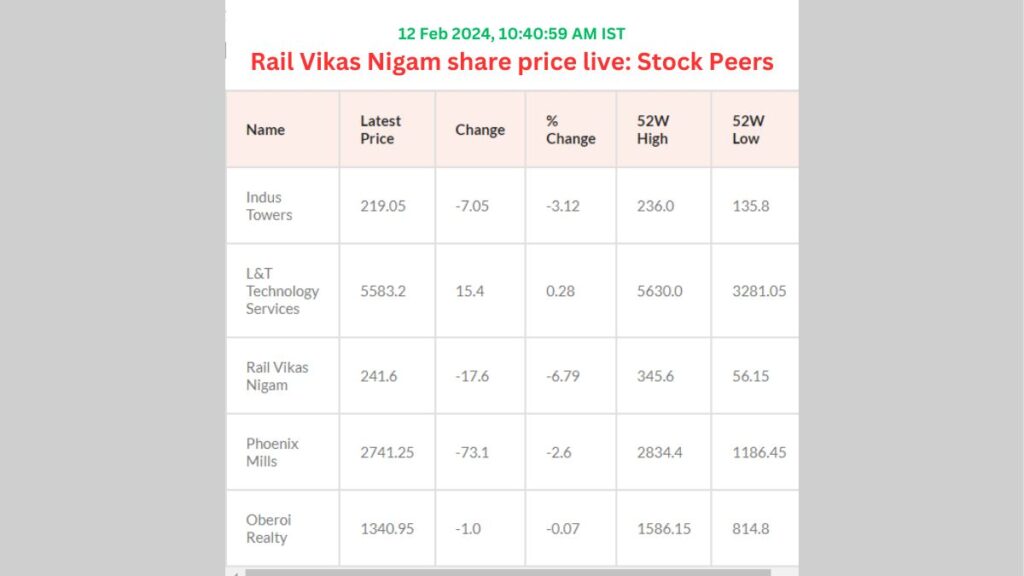

Rail Vikas Nigam’s recent share price movements indicate a volatile trading session, with the stock opening at ₹256.15 and closing at ₹281.7. Throughout the day, it experienced fluctuations, reaching a high of ₹272.85 and a low of ₹250.4. Despite the intraday volatility, the stock managed to close higher, reflecting potential investor optimism or buying interest. The company’s market capitalization stands at ₹54,043.72 crore, showcasing its significant presence in the market. However, the stock’s performance over the past 52 weeks reveals a wide range, with a high of ₹345.6 and a low of ₹56.15, suggesting both potential upside and downside risks for investors

Analyst forecasts and projections

Analyst forecasts and projections for Rail Vikas Nigam’s stock may vary based on factors such as the company’s financial performance, industry trends, and macroeconomic conditions. Analysts typically consider key metrics like revenue growth, profitability margins, and project pipelines to formulate their forecasts. Additionally, market sentiment and investor confidence also play a crucial role in shaping analyst expectations. Investors should pay attention to analyst reports and recommendations to gain insights into the potential future trajectory of Rail Vikas Nigam’s stock price.

Comparison with industry peers and broader market indices

Rail Vikas Nigam’s performance can be compared with its industry peers and broader market indices to gauge its relative strength and competitiveness. By assessing metrics such as revenue growth, profitability, and market capitalization, investors can evaluate how RVNL stacks up against its peers within the railway infrastructure sector. Furthermore, comparing RVNL’s stock performance with broader market indices like the BSE Sensex or Nifty can provide insights into its overall market performance and potential correlations with broader economic trends. This comparative analysis can help investors make informed decisions regarding their investment in Rail Vikas Nigam’s stock.

Conclusion:

In conclusion, Rail Vikas Nigam Limited (RVNL) continues to navigate dynamic market conditions, as evidenced by its recent share price movements and analyst projections. Analyst forecasts and projections play a crucial role in shaping investor sentiment, as analysts consider various factors such as financial performance, industry trends, and market dynamics. Furthermore, comparing RVNL’s performance with industry peers and broader market indices provides valuable insights into its relative strength and competitiveness. As investors monitor RVNL’s developments closely, they should consider a holistic view of the company’s performance and market positioning to make informed investment decisions.

also read Rail Vikas Nigam stocks plummet in trading today

Disclaimer: This article aims to provide insights into the recent developments surrounding RVNL shares and does not constitute financial advice. Investors are encouraged to consult with their financial advisors for personalized guidance tailored to their individual circumstances and risk tolerance.

2 thoughts on “RVNL Share Price and India’s Infrastructure Story: Beyond the Numbers”

Comments are closed.