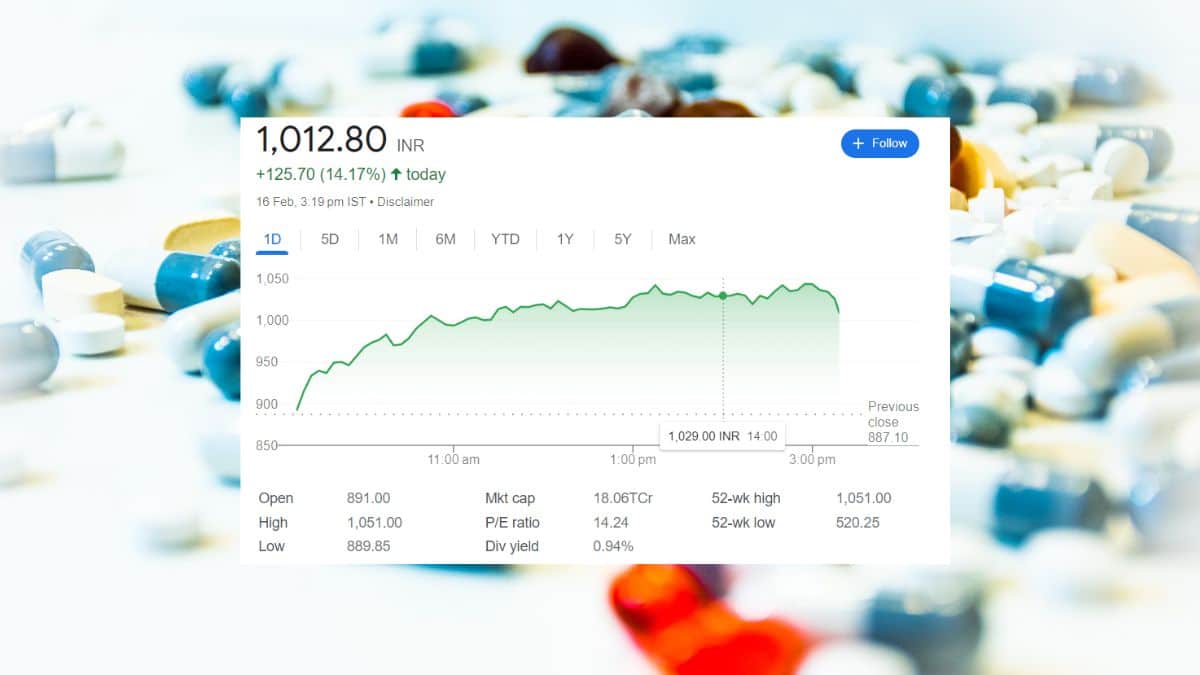

NATCO Pharma Share Price: In a day marked by significant market movements, Natco Pharma, the Hyderabad-based Indian multinational pharmaceutical company, saw its shares soar by a remarkable 14.17% by 3:19 pm, reaching a peak value of 1051.00. This surge comes in the wake of the company’s Q3 financial results, which have elicited a mixed response from analysts and investors alike.

also read: UK Economy Enters Recession: 6 Strategies for PM Rishi Sunak to Navigate Recovery

Natco Pharma’s Q3 FY24 revenue fell slightly below expectations, but its EBITDA margin remained in line with estimates. The company reported a robust 54% year-on-year revenue growth, primarily driven by a low base in the exports business and the ramp-up in the crop protection business, notably led by CTPR. While domestic formulations experienced a marginal decline of around 2% year-on-year, export formulations witnessed a substantial growth of 81.5% year-on-year, bolstered by new product launches.

One of the standout achievements in the quarter was the remarkable improvement in EBITDA margin, which surged by 1348 basis points to 35.3%. This improvement was primarily attributed to the contribution of Revlimid, new product launches, and reduced price pressures in the U.S. market.

However, amidst the optimism surrounding these results, cautionary notes have been sounded by analysts. Nirmal Bang, in its report, expressed cautiousness about Natco Pharma’s growth trajectory, highlighting its heavy reliance on the performance of Revlimid and CTPR. Excluding these two segments, there appears to be limited near-to-medium-term visibility in either the U.S. or domestic markets.

Revlimid, a key revenue driver for the company, plays a critical role in shaping Natco Pharma’s financial performance. Any fluctuations or challenges in its sales trajectory could significantly impact the company’s overall growth outlook. Similarly, while the crop protection business has shown promise, its sustainability and scalability remain subject to market dynamics and regulatory factors.

The company’s market capitalization currently stands at a substantial 18.06 trillion INR, reflecting investor confidence in its prospects. With a price-to-earnings ratio of 14.24 and a dividend yield of 0.94%, Natco Pharma continues to be an attractive investment proposition for many.

Looking ahead, Natco Pharma finds itself at a crucial juncture, balancing the need for sustained growth with the challenges posed by market uncertainties and regulatory pressures. As it navigates through these complexities, the company’s ability to diversify its revenue streams, innovate in its product offerings, and effectively manage its cost structures will be key determinants of its long-term success.

In conclusion, while the recent surge in Natco Pharma’s share price underscores the market’s confidence in its potential, stakeholders must remain vigilant amidst the evolving landscape of the pharmaceutical industry. The company’s strategic decisions and execution prowess will ultimately shape its journey towards achieving sustainable growth and delivering value to its shareholders.

also read Natco Pharma Q3 Results Review -Caution On Growth Drivers, Strategic Shifts: Nirmal Bang

Disclaimer: The contents of this section do not constitute investment advice. For that, you must always consult an expert based on your individual needs.

1 thought on “NATCO Pharma Share Price: Natco Pharma Surges 14.17% Following Q3 Results, A Deep Dive”

Comments are closed.