Hindustan Aeronautics Limited News: Hindustan Aeronautics Limited (HAL) showcases strong quarterly performance and strategic advancements, reinforcing its position as a key player in India’s defense sector, with Prabhudas Leeladhar recommending a target price evaluation based on robust prospects.

also read RVNL Share News: Insights into Market Performance and Project Developments

Quarterly Performance: Hindustan Aeronautics Limited News

Hindustan Aeronautics Limited (HAL) has reported a noteworthy 7.0% year-on-year revenue growth in the third quarter of fiscal year 2023-24. Accompanying this growth is a substantial expansion in EBITDA margin, which surged by 629 basis points to 23.7%. This commendable performance is attributed to operational efficiency improvements, particularly driven by lower provisions.

Strategic Developments

A significant milestone for HAL is the recent approval from the Defence Acquisition Council for the acquisition of approximately 97 additional Tejas Mk1A aircraft, around 156 LCH Prachand helicopters, and the indigenous upgradation of about 84 Su-30MKI aircraft. This underscores HAL’s pivotal role as the primary supplier of military aircraft to India, reinforcing its position in the nation’s defense ecosystem.

Government’s Commitment to Defense Modernization

The interim budget for the fiscal year 2025 has allocated a substantial increase of about 44% in capital outlay on aircraft and aero engines for defense forces, amounting to Rs. 408 billion compared to Rs. 282 billion in the previous fiscal year. This significant allocation underscores the government’s steadfast commitment to indigenous procurement in defense, providing HAL with a promising long-term demand outlook.

Technological Advancements and Future Prospects

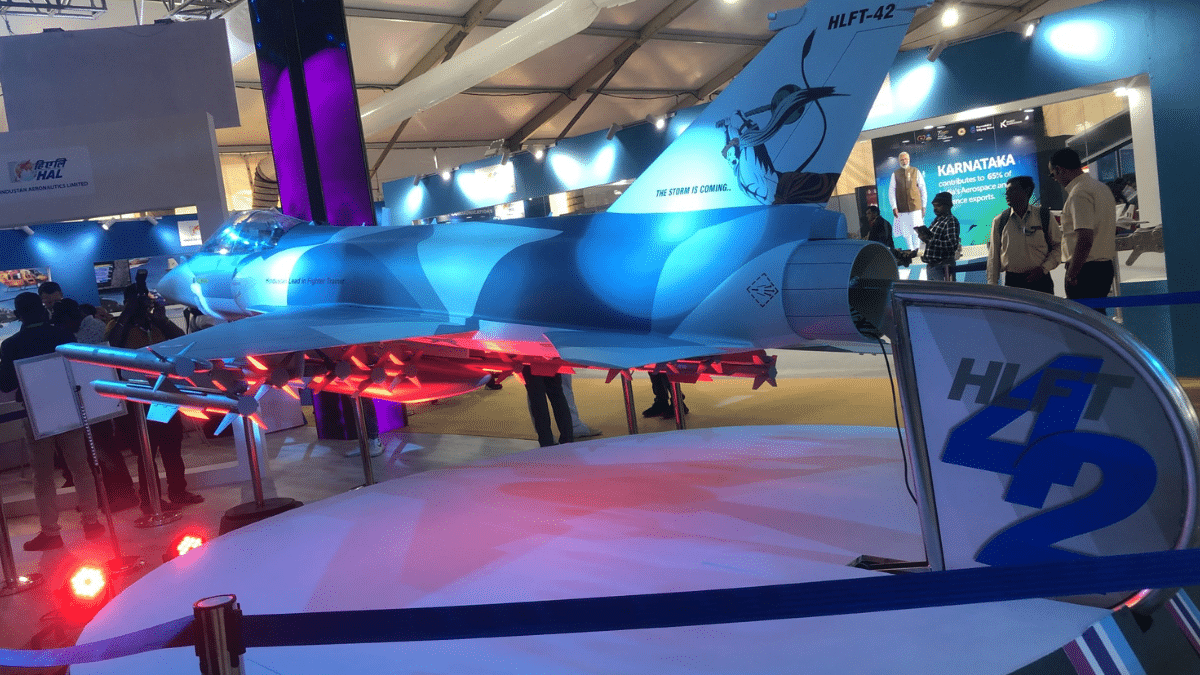

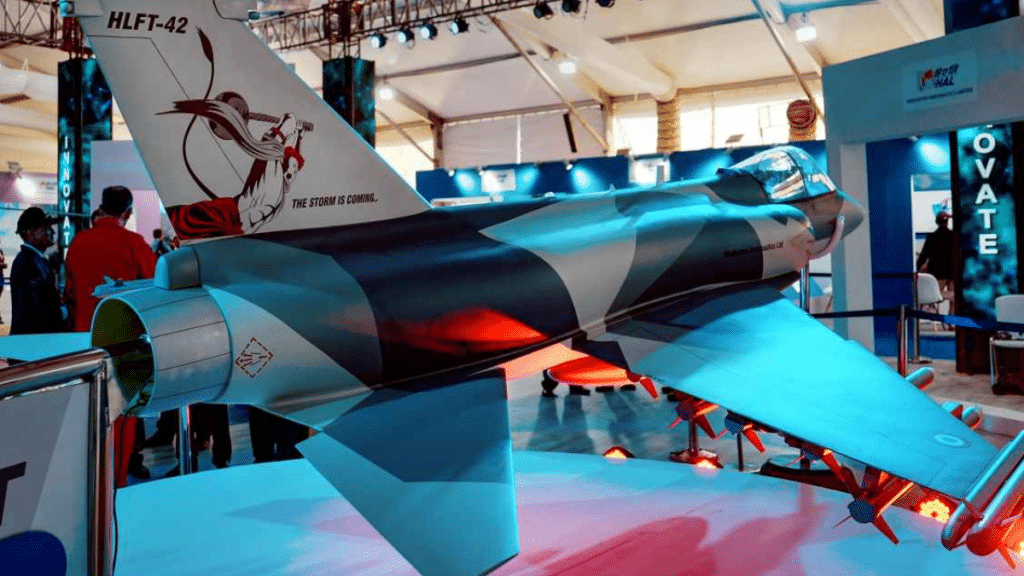

HAL’s technological prowess has been on a steady ascent, propelled by its involvement in the development of advanced platforms such as Tejas and AMCA. This leap in technological capabilities not only enhances HAL’s competitiveness but also positions it as a key player in India’s defense modernization efforts.

Financial Outlook: Hindustan Aeronautics Limited News

HAL boasts a robust order book coupled with a promising five-year pipeline exceeding Rs. 2 trillion, solidifying its revenue visibility and growth prospects. Furthermore, the company has demonstrated improvements in profitability through scale and operating leverage.

Prabhudas Leeladhar recommends a target price evaluation for HAL, utilizing an equal-weighted average of discounted cash flow (DCF)-derived price and price-to-earnings (P/E) derived price based on 28 times the estimated earnings for fiscal year 2026. At present, the stock is trading at attractive valuations, with a price-to-earnings ratio of 32.1x and 28.3x on estimated earnings for fiscal years 2025 and 2026, respectively.

Conclusion: Hindustan Aeronautics Limited News

Hindustan Aeronautics Limited stands poised for continued success, driven by its strategic positioning, technological advancements, and a supportive regulatory landscape. Investors keen on participating in India’s defense modernization journey may find HAL to be an appealing long-term investment opportunity.

Disclaimer: This article is based on publicly available information and does not constitute financial advice. Investors should conduct their research or consult with a financial advisor before making investment decisions.

also read Hold Hindustan Aeronautics; target of Rs 2787: Prabhudas Lilladher